How Can I Invest In Japanese Real Estate?

Japan is a safe haven for wealthy individuals in Asia," said Mori Nishimura of Housing Japan. "Nowhere else in Asia can you buy freehold land as a foreigner".

"Some international investors are looking for rental yields and to diversify their holdings outside their home countries, while others just want to have a holiday home in Japan." said Robert Crane of Solid Real Estate.

Most foreign investors are from Singapore, Malaysia, Thailand, Hong Kong, and Mainland China. There is also a growing interest from the US, Australia, Western Europe, Taiwan and Indonesia. Estate One provides a variety or investment programs and selected properties to our investors. Investors can easily glance the list of properties through our portal We also provide customized search in accordance to clients’ requirement. That includes rental management, target property such as a boutique hotel at popular locations.

Japan Statistics

Property prices in Tokyo, Japan surpass their highs in the 30-year bubble era

According to the Institute of Real Estate Economics of Japan, the price of newly built apartments in the capital Tokyo in 2020 will rise by 1.7% to 60.84 million yen (about 4.54 million Hong Kong dollars), which is the highest since the record of 61.23 million yen in 1990, which was recorded in more than 30 years.

The increase in construction costs due to preparations for the Tokyo Olympics and the conversion of residential buildings in the Linhai Industrial Zone have driven up local property prices.

According to the agency's data, the most expensive apartment unit is located in Daikanyama and is worth 690 million yen (about 52 million Hong Kong dollars).

As for the number of apartment units sold last year, it fell by 12.8% year-on-year to 27,228 units, a 70% drop from 1990 levels.

Source: Infocast Newswire

Number of immigrants to Japan

2020 (as of June) : 2,885,000 people

2019 : 2,930,000 people

Source : Immigration Services Agency of Japan

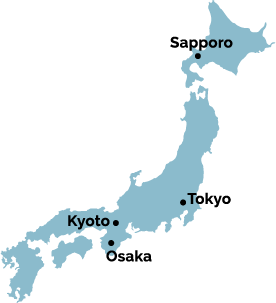

Tokyo Metropolitan Real Estate Investment in the world: No. 4 in 2019, rising to No. 1 in 2020.

| 2020 Jan-Sept | 2019 Jan-Sept |

|

|

Japan is the 3rd largest economy in the world.

Largest economies by nominal GDP in 2019

USA $ 22 trillion

China $ 14 trillion

Japan $ 5 trillion

Germany $ 4 trillion

India $ 3.5 trillion

UK $ 3 trillion

France $ 3 trillion

The 2nd largest amount of foreign currency reserves

Millions of foreign exchange reserves

Japanese Yen has increased 22% against CNY since 2016, yet remains relatively stable against USD

Japan is ranked the 4th Healthiest Country among the world and 1st in Asia in 2019

Real Estates in Japan

Well established legal system and regulations

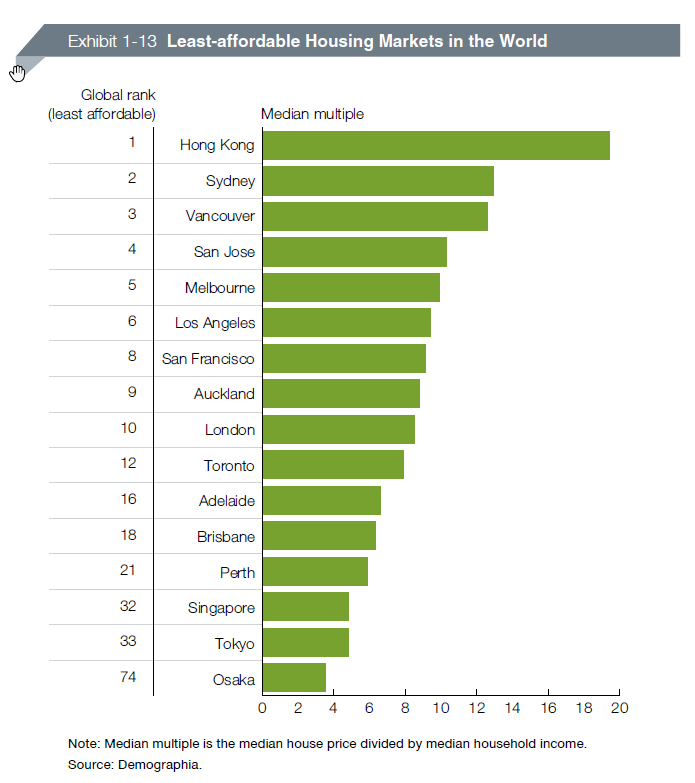

Relatively lower property prices compared to Overseas Real Estate Markets

Attractive Yield, High demand and occupancy rates

Occupancy rate in Japan major cities

Occupancy rate in Tokyo

Tokyo and Osaka are two of the Top Investment Cities in 2019 with very good investment prospects